nj 529 plan tax benefits

What are some New Jersey 529 plan benefits and tax advantages. 529 plans allow account owners friends and family to contribute to a college fund with after-tax income and enjoy two types of potential tax benefits.

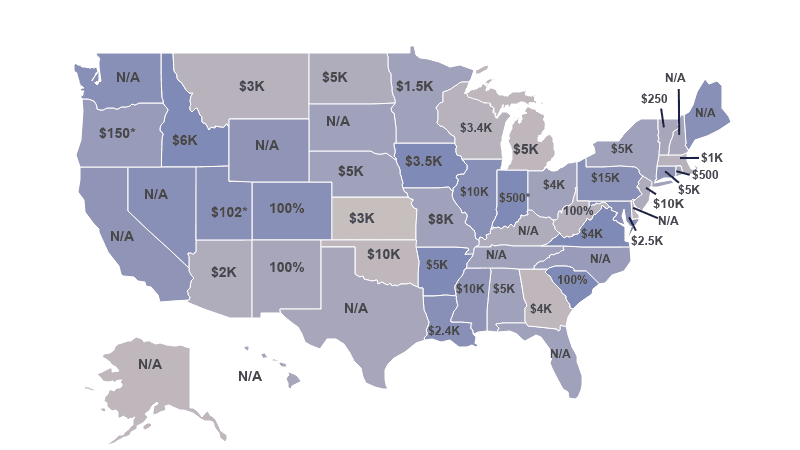

529 Tax Deductions By State 2022 Rules On Tax Benefits

Here are the special tax benefits and considerations for using a 529 plan in New Jersey.

. New Jerseys Higher Education Student Assistance Authority HESAA can. Unlike traditional IRAs and 401s 529 plan contributions are not tax deductible at the federal level. The Vanguard 529 College Savings Plan is a Nevada Trust administered by the office of the.

Thanks to recent legislation however you may now be able to deduct up to. NJBEST New Jerseys 529 College Savings Plan is offered and administered by the New Jersey Higher Education Student Assistance Authority. New Benefits For New Jersey Residents.

New Jersey will offer a state tax deduction of up to 10000 per taxpayer per. Section 529 - Qualified Tuition Plans. A 529 plan is designed to help save for college.

New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction. Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529. This state does not offer any tax benefits for.

However Indiana Utah and Vermont offer a state income tax credit for. And funds that the student eventually withdraws from. New Jersey Tax Benefits.

LinkedIn StumbleUpon Google Cancel. Thanks to recent legislation however you may now be able to deduct up to. As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of.

A key benefit of both NJ 529 plans is the NJBEST Scholarship. Contributions to such plans are not deductible but the money grows tax-free while it. What Makes NJBEST Special for New Jersey Families.

The NJBEST Scholarship is not need-based means-tested or. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. Either the child or the account owner must be a NJ resident.

On top of the tax benefits there are a number of other college-related benefits for New Jerseyans. In and out-of-state participants get the federal tax benefits. Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level.

New Jersey 529 Plans. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. Plan data as of 052919.

529 plans typically increase the contribution limit over time so you may be able to contribute more. Tax Benefits of the NJBEST 529 College Savings Plan When you invest in any 529 college savings plan the earnings your contributions make in the market grow tax-deferred. Other state benefits may include financial aid scholarship funds and protection from creditors.

36 rows The most common benefit offered is a state income tax deduction for 529 plan contributions. Funds you invest in a 529 plan grow tax-deferred.

529 Plan Maximum Contribution Limits By State Forbes Advisor

529 College Savings Plan Options Broken Down By State

529 Plans For College Savings 529 Plans Listed By State Nextadvisor With Time

Pre Tax Funding For College Education Under The Tax Cuts Jobs Act Clark Nuber Ps

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2019 Kap Kksp Partners

States That Offer 529 Plan Tax Deductions Bankrate

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

529 Plan Tax Benefits And Advantages Learning Quest

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

Best 529 Plans Reviews Ratings And Rankings White Coat Investor

Plan Details Information Minnesota College Savings Plan

New Jersey 529 Plan And College Savings Options Njbest

A Tax Break For Dream Hoarders What To Do About 529 College Savings Plans

529 Tax Benefits The Education Plan

N J S 529 Plan Now Offers A Tax Break But Is It Enough Of An Incentive Nj Com

Tax Benefits Nest Advisor 529 College Savings Plan

The Top 9 Benefits Of 529 Plans Savingforcollege Com

Wealthfront College Savings White Paper Wealthfront Whitepapers